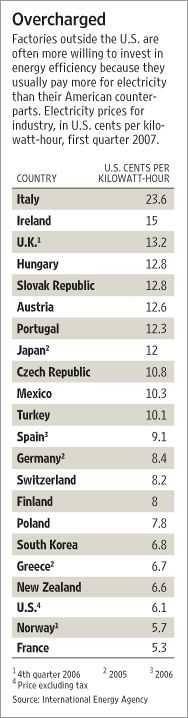

Companies use a big share of the world’s energy. Here’s how some of them are cutting back.By LEILA ABBOUD and JOHN BIERS Scientists and politicians are searching for big ideas to help the environment. But companies across the world are slowly waking up to a simpler solution: Use less power. Businesses are some of the world’s biggest energy consumers. They need huge amounts of electricity to keep their factories humming and their stores air-conditioned, as well as countless gallons of gasoline for their delivery trucks. Consider this: The manufacturing sector alone accounts for nearly one-third of the world’s global energy use, especially heavy industries like chemicals, iron and steel, cement, paper and aluminum. Now, with oil, gas and electricity prices soaring, companies are beginning to realize that saving energy can translate into dramatically lower costs. And that means higher profits and happier shareholders — not to mention a cleaner planet. So, companies are beginning to pour more money into making old equipment energy-efficient or upgrading to cleaner models. And they’re starting to streamline their operations to cut down on waste. Even companies with longstanding energy-saving programs are redoubling their efforts in light of rising fuel costs and greater pressure from the public to address global warming. Wal-Mart Stores Inc. — which by some measures is the world’s second-largest energy purchaser after the U.S. government — has undertaken a multiyear campaign to retrofit older stores with new lighting and air-conditioning systems. Company officials boast that many of these energy projects pay for themselves within two years. Energy efficiency “is one of the best investments we can make,” says Charles Zimmerman, Wal-Mart’s vice president of prototype and new format development. The potential savings from such projects are enormous. A recent study from the International Energy Agency showed that energy use in heavy industry could be reduced by 18% to 26% just by applying best practices and available technologies. That savings is equivalent to about one to one-and-a-half times Japan’s annual energy needs, the agency said. Light industries, like retailing and the food sector, could cut energy use by an even greater percentage — up to 50% — because they haven’t always made efficiency a priority, says Paul Waide, an energy-efficiency analyst at the Paris-based IEA. Still, most companies are moving slowly in implementing these types of changes — if at all. For one thing, they must balance energy efficiency against other concerns. Should a manufacturer replace machinery that still works fine just to bring in more energy-efficient models? Or should it spend that money on much-needed capital improvements? In some cases, companies have made all the easy fixes they can, leaving only expensive measures that will take years to return their cost in energy savings. Corporate structure can be another obstacle. Often, says the IEA’s Mr. Waide, no one person is in charge of minimizing energy use — so the various parts of a company are often at odds. “The procurement office might just be looking for the cheapest motor to install in terms of upfront cost,” he says. “The energy bill gets paid out of some other budget, so unless the company as a whole focuses on the issue, nothing gets done.” THE JOURNAL REPORT There’s also the natural inclination to ignore waste — especially if it means accepting blame for the inefficiency. Christopher Russell, principal of Energy Pathfinder Management Consulting, a Baltimore firm that helps companies save energy, says companies should declare a kind of “amnesty” on past behavior when setting up efficiency efforts. On top of that, companies often don’t know what targets to aim for. Little benchmarking data exists on how companies in the same industry stack up against one another in terms of energy use. Even within one company, executives don’t always know how their offices or factories stack up. What follows is a sector-by-sector look at what some companies are doing to save energy: the successes they’ve achieved, the pitfalls and trade-offs they face and the lessons they’ve learned. Heavy Manufacturing On paper, many industrial companies could achieve quick improvements in energy efficiency by replacing older equipment: steam systems that don’t recover enough heat, motors that run constantly and boilers that lack proper insulation. But in the real world, all that new machinery is often costly — so energy efficiency becomes a series of trade-offs. Take California Portland Cement Co., a 114-year-old Glendora, Calif., company that started an energy-saving program in 2003 as electricity prices soared. Controlling energy use is a priority in cement manufacturing, which transforms limestone into the age-old building material through a series of work-intensive processes that involve crushing, blending, heating and cooling. California Portland’s manufacturing operations include a mix of Eisenhower- and Nixon-era machinery — a source of both opportunity and frustration for Steve Coppinger, the company’s energy manager. “If the upfront costs didn’t matter, there are new technologies that are much more energy-efficient and much more environmentally friendly,” he says. But energy-efficiency upgrades “have to compete with other investments,” such as new loading systems to provide cement to customers more quickly, or new trucks for the quarry. So, Mr. Coppinger says, the company is upgrading its plants gradually. Energy-efficiency projects need to pay for themselves in three years or less to win financing. Some of the changes California Portland has made include revamping its systems to deliver compressed air, which is used to drive many processes or move objects on the production line, and replacing 1970s-era kilns at its Rillito, Ariz., plant. TRIMMING ENERGY USE The company has also done some pricier projects. For instance, the company’s biggest efficiency investment came last year: a $31 million grinding mill at its Mojave, Calif., plant that replaced five 1950s-era units. The mill delivers about $2 million a year in energy savings and helped the company garner a $550,000 rebate from its utility. Mr. Coppinger estimates that the new mill is 40% more energy-efficient than the prior system, a major benefit given that the system runs 24 hours a day most days. It’s also more efficient overall, grinding more quickly than the old model and helping out tremendously during periods of peak demand. The company could improve energy efficiency with a similar new mill at its Rillito plant, Mr. Coppinger says. But the company hasn’t made the move. In part, that’s because power costs in Arizona are far lower than in California, so there’s less incentive to switch. Also, Mr. Coppinger says, the company has already upgraded some systems in Rillito, so the benefits would be more “incremental” than at Mojave. For manufacturers overseas, the cost equation is often different. Factories in countries with higher energy costs, such as in much of Europe, are often more willing to spend money upfront to become more efficient. Food and Beverages Companies in the food and beverage business are all over the map when it comes to energy efficiency. Most of the efficiency efforts are coming from the big names in the sector — while many smaller companies don’t even have anyone monitoring their energy use and looking for savings. One energy-conscious operation is Arla Foods, a farmer-owned cooperative based in Denmark and the world’s fifth-largest dairy producer by revenue. Denmark has among Europe’s highest taxes on energy consumption, so Arla had to cut energy use to stay competitive and profitable. “It’s a matter of survival,” says Per Morgen Christiansen, the director of the co-op’s Fredericia dairy, which has undergone major upgrades in recent years to become more energy-efficient. Arla’s environmental plan for 2006 to 2010 aims to cut energy and water use by a further 5% each. Arla has undertaken about a dozen projects to save energy, such as changing to a new water chiller, replacing the absorption dryer in the cheese-aging room and repairing leaks in compressed-air pipes. A big consideration in weighing these projects is payback time. If a change pays for itself in one to two years, then it usually gets the green light. But Arla has undertaken some efforts with a longer payback time. The new water chiller, for instance, cost about $140,000 and saved 290,000 kilowatt-hours of electricity per year, which is similar to what nearly 30 U.S. homes use annually, according to the Department of Energy. The project had a payback time of more than four years. Such projects are usually approved because they offer some other benefit. The new machines might break down less, for instance, or improve worker safety. Now it’s mostly pricey projects that remain, such as a new machine to dry the cheese that would cost some $240,000. “Now that we’ve done all the easy things, saving energy gets a bit harder,” says Mr. Christiansen. In addition to changes in the dairies themselves, Arla aims to cut the fuel it uses for transport by 5%. The co-op has bought new, more efficient delivery trucks and planned out their routes to minimize unneeded driving. It has also installed computers in some trucks to record fuel consumption and help drivers alter their habits, such as cutting down on the time spent idling. Heineken NV, Europe’s largest beer maker and seller of Heineken and Amstel in some 170 countries, also got a head start on energy efficiency. It began its efforts some 15 years ago because its home country of the Netherlands had a strict policy aimed at ratcheting down industrial energy use. Heineken negotiated voluntary agreements with the government: If it reduced energy use at its breweries, it would receive tax breaks. If it didn’t, it would face penalties. Energy savings remain a priority at Heineken today, says Jaco Bakker, who is in charge of environment and safety at the brewer’s Netherlands plants. The company aims to use 15% less energy in 2010 than it did in 2002, and is trying to use less water and heat as well. The company’s brewery in Zoeterwoude, the Netherlands, is among the most efficient in the world. The brewery burns natural gas on-site to create electricity, and uses the excess heat created to heat huge vats of barley, hops and water. Another innovation: Heineken converts the waste water generated in the brewing process into gas that can be burned to generate up to 10% to 15% of the plant’s electricity. Heineken is now trying to export its best energy-savings practices to all of its breweries. One important step in the effort was benchmarking. Four years ago, Heineken embarked on an effort to measure energy use at all 65 of its breweries world-wide. “We wanted to be able to compare all our plants against each other,” recalls Mr. Bakker. “To save energy you need to set targets. Information is crucial.” Support from the top has also been vital. When the effort, dubbed Project Aware of Energy, was launched, the CEO sent a videotaped message to all the brewery managers world-wide, urging them to get on board with energy efficiency. The tape was important, recalls Mr. Bakker. Once the message went out, Heineken saw more ideas bubbling up from the plant workers and managers — the people on the ground with the best ideas about how to squeeze energy savings out of processes. Mr. Bakker adds that the message made the brewery managers realize that they would be benchmarked and judged against other breweries, so they had added incentive to make real reforms at their sites. “There has to be direction set from the top of the company,” Mr. Bakker says. “Then you need to let the people on the ground come up with the solutions. They have the best ideas.” High Technology Most people don’t think of gadgets like computers and mobile phones as polluters or energy guzzlers. But an April 2007 analysis from technology consultants Gartner Inc. showed that 2% of the world’s carbon-dioxide emissions came from information-technology equipment during all the stages of its life cycle — from manufacturing and distribution to use by consumers to disposal. That’s about the same amount of pollution that the aviation sector generates. “The good news is that because energy management isn’t something the IT industry has worried about in the past, there is so much low-hanging fruit” in terms of potential energy savings, says Simon Mingay, an analyst at Gartner. Europe’s biggest semiconductor maker, STMicroelectronics, has focused on energy savings for the past 15 years because its former CEO, Pasquale Pistorio, was a devoted environmentalist. The effort has paid off for the Geneva-based chip maker: It saved a net $1 billion from 1994 through 2006 by revamping its factories to use less energy. The projects, which included retrofitting machines and sealing compressed-air leaks, cost about $300 million, estimates Georges Auguste, director of quality and corporate responsibility. For instance, at its plant in Singapore, STMicroelectronics zeroed in on one piece of equipment that was running inefficiently: a heat exchanger that is used to cool water for use on the production line. The engineers realized that gunk from the water was building up in the tubes where the water is cooled. That slowed down cooling and made the exchanger suck up more electricity. The engineers designed a simple solution: Once a month, small rubber balls were forced down the cooling tubes to unclog them. Mr. Auguste estimates that the fix saved 6 to 15 gigawatt-hours of electricity a year, or $500,000 to $1 million. Such attention to detail has helped STMicroelectronics cut in half the energy it consumes per unit produced since 1994. Gartner’s Mr. Mingay says that such efforts are crucial because 70% to 80% of the energy used in IT comes in manufacturing and transporting the goods. But now big tech consumers — such as financial institutions with big data centers — are also becoming more conscious of energy efficiency. HSBC Holdings PLC, the international bank, made energy efficiency in its technology and data centers a big part of its effort to cut its carbon-dioxide emissions. In June, the bank said it would spend $90 million over five years to become more energy-efficient in its 10,000 offices, with the target of reducing power consumption by 7% by the end of 2007. Some changes: software that automatically turns off desktop computers if employees leave them on at night and replacing computer monitors with newer, more-efficient models. Retailing A key decision for any company that wants to reduce energy costs is where to entrust accountability and authority. Wal-Mart, like other big retailers, has centralized that power at its corporate headquarters.

There, a monitoring team of some 100 specialists keeps constant track of the energy use at some 4,000 Wal-Mart and Sam’s Club stores in the U.S. and Canada. They have control over key systems, including air conditioning — which the company sets at 75 degrees for all its North American stores during the summer. If a store manager wants the temperature lower, the Bentonville staff will ask a series of questions, such as the exact spot in the store that feels too warm and whether there are any obvious problems with the ventilation system. “Its not like a store manager can turn down a thermostat two degrees,” says Mr. Zimmerman, the retailer’s vice president of prototype and new format development. “He has to call us to make that happen.” The way Wal-Mart sees it, local management should be minding other issues at the stores. “We take care of their systems,” Mr. Zimmerman says. The store manager “should be taking care of customers.” Headquarters also monitors stores’ energy usage for problems. For instance, if a freezer door is kept open for 45 minutes, a sensor will alert Bentonville, generating an official query. Headquarters can then tap a national network of contractors to fix the problem — sometimes before the store manager even knows there’s a problem. The “monitoring team saves the company millions of dollars by detecting and responding to situations that could cause Wal-Mart to lose money on wasted energy or spoiled food,” says spokesman Dave Tovar. Wal-Mart is looking to cut energy costs in other ways. It is reducing food-delivery trips by buying more produce closer to customers. For instance, the company now buys peaches from 18 states in the U.S., up from two. “Right now, a lot of the price of that product can be coming from the fuel,” says Andy Ruben, Wal-Mart’s vice president for business, strategy and sustainability. Meanwhile, the company has heavily touted its new “high efficiency” stores, which employ wind power and “waterless” urinals, as well as state-of-the-art air conditioning/heating and refrigeration systems. The company has also embarked on a plan to retrofit key systems in many older stores. Wal-Mart will meet a target to reduce energy use by 20% in existing stores by 2012, Mr. Zimmerman says. Many of the savings will come through lighting innovations. Widespread use of light-emitting-diode lighting in refrigerated displays, for example, could cut the displays’ energy use by 80%, he says. Wal-Mart officials say they are also, as Mr. Ruben puts it, “pushing the envelope” in prodding suppliers to eliminate excess packaging and encouraging consumers to choose more-efficient products. Environmentalists are watching carefully to see if the company’s efforts are sustained and that it lives up to its public relations. And a recent visit to a Houston store on a sticky Sunday suggests Wal-Mart treads lightly before it does anything that rattles shoppers too much. The store included environmentally friendly skylights in some areas, and was maintained at a temperature that — while comfortable — was warmer than many other area stores. But there was evidence of energy waste: a row of some three dozen TV sets, all of which were on. Mr. Ruben says Wal-Mart will prominently showcase more environmentally friendly products but won’t stop selling competing ones, such as less-efficient bulbs. Similarly, Mr. Ruben defends the TV display as necessary in today’s competitive environment for consumer electronics. “Everything we do comes back to what makes the most sense for the customer,” he says.

|